Written By: Mike and Dylan O’Neil

How Much Should It Cost You?

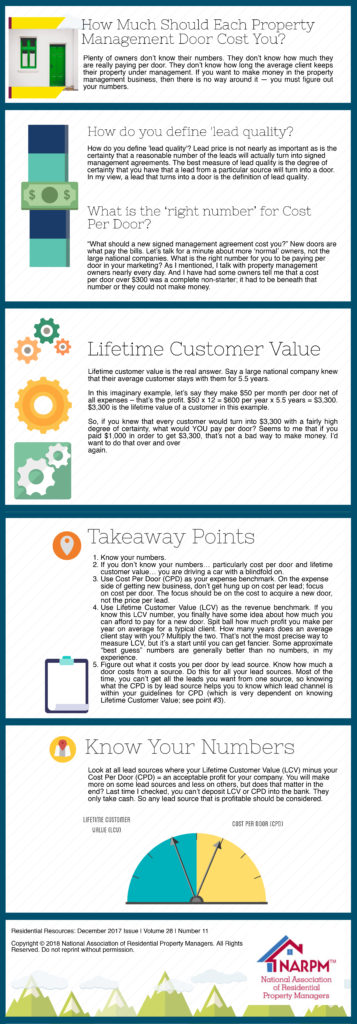

Property Management Door

It’s popular among larger regional property management companies or national companies to approach smaller property management companies with 50-600 doors and offer to buy their portfolio of management agreements. In a recent podcast, hosted by Jordan Muela of LeadSimple, it was said that larger regional property management companies or national companies will pay between $500 to $2,500 per door when they are purchasing a portfolio, depending on various factors.

It’s popular among larger regional property management companies or national companies to approach smaller property management companies with 50-600 doors and offer to buy their portfolio of management agreements. In a recent podcast, hosted by Jordan Muela of LeadSimple, it was said that larger regional property management companies or national companies will pay between $500 to $2,500 per door when they are purchasing a portfolio, depending on various factors.

Let that sink in: $500 to $2,500 PER DOOR. How does that compare to what YOU think your cost per door needs to be at your property management company?

In any universe, would you even consider paying $2,500 for a door? What black magic are these national companies practicing?

How important is cost per lead?

I speak with property management company owners pretty much every day. In selling property management leads, one of the normal questions that comes up is, “How much does a lead cost?” It’s a reasonable question. But in the overall scheme of things, it’s one of the less important questions. I know that will sound controversial to some readers here, so let me defend my statement.

How much would you pay for a lead that had a 1% chance of turning into a management agreement? This is the ‘Thumbtack game’ – cheap leads with long odds of closing. Some owners like that game; most hate it. Why?

It’s a game for lowball price companies and, therefore, I think most owners put the value of such a lead at zero. On the other hand, how much would you pay for a lead that has a 100% chance of closing? This might be a referral from a highly-trusted source or maybe your mother is a real estate agent (lucky you).

So there you have the range of certainty of closing – 1% to 100%. So how much should those leads cost when they have such different closing certainties associated with them?

How do you define ‘lead quality’?

Before we address the question, “How much should a lease cost?”, I want to point out something. In order to talk about “What should a lead cost?”, we had to sneak in another idea – the certainty that the lead will CLOSE. This is really where all the focus should be. Lead price is not nearly as important as is the certainty that a reasonable number of the leads will actually turn into signed management agreements.

This is another way to say that ‘lead quality’ is the more important measure, instead of the price of the lead. But how do you measure lead quality? I suggest that the best measure of lead quality is the degree of certainty that you have that a lead from a particular source will turn into a door. In my view, a lead that turns into a door is the DEFINITION of lead quality.

What is the ‘right number’ for Cost Per Door?

So I’m going to skip the “What should a lead cost?” question to get to the real question here – “What should a new signed management agreement cost you?” New doors are what pay the bills.

Let’s talk for a minute about more ‘normal’ owners, not the large national companies. What is the right number for you to be paying per door in your marketing? As I mentioned, I talk with property management owners nearly every day. And I have had some owners tell me that a cost per door over $300 was a complete non-starter; it had to be beneath that number or they could not make money.

On the other hand, I have other owners who have told me that they are interested in buying doors for $1,000 each if I can direct them to anyone who is selling. So what is going on here? How can some owners not make it when their cost per door is over $300 and others, who probably know their numbers pretty well, will pay up to $2,500 per door? That’s a ridiculous difference, agreed?

You Must Know Your Numbers

Let me address one thing I’m pretty certain of right off the top – plenty of owners don’t know their numbers. They don’t know how much they are really paying per door. They don’t know how long the average client keeps their property under management. I am not speculating here – this is a fact. I know it’s a fact because I routinely ask about cost per lead, cost per door, and such. When I do, I regularly get an awkward silence over the phone.

I’m sympathetic to these owners. It’s tough to keep track of all the numbers. But if you want to make money in the property management business, then there is no way around it — you must figure out your numbers.

Lifetime Customer Value

But what about those who DO know their numbers? How can there be such a range in terms of the value of a door?

Lifetime customer value is the real answer. In that same podcast noted above, the large national company knew that their average customer stays with them for 5.5 years. So, in my imaginary example, let’s say they make $50 per month per door net of all expenses – that’s the profit. $50 x 12 = $600 per year x 5.5 years = $3,300. $3,300 is the lifetime value of a customer in this example. So, if you knew that every customer would turn into $3,300 with a fairly high degree of certainty, what would YOU pay per door? Seems to me that if you paid $1,000 in order to get $3,300, that’s not a bad way to make money. I’d want to do that over and over again.

Takeaway Points

I know, I know… you’re not a large national company. And maybe you can’t afford to finance your marketing for a year or so until the profits pay back your lead expenses. I get it. But there is something to learn from this conversation here for every company, no matter what the size. Let me suggest some lessons:

- Know your numbers. Everyone knows they should do this, but in my experience, precious few actually DO.

- If you don’t know your numbers… particularly cost per door and lifetime customer value… you are driving a car with a blindfold on – good luck with that.

- Use Cost Per Door (CPD) as your expense benchmark. On the expense side of getting new business, don’t get hung up on cost per lead; focus on cost per door. I’m not sure that $8 leads are worth it for most owners; you get what you pay for there. On the other hand, I bet I could get a long line of buyers if my company was selling leads 100% guaranteed to close for $500 each. The point? The focus should be on the cost to acquire a new door, not the price per lead.

- Use Lifetime Customer Value (LCV) as the revenue benchmark. If you know this LCV number, you finally have some idea about how much you can afford to pay for a new door. If your LCV is $2,000 then you can decide how much of that is reasonable to spend to get a new door. Most owners I speak with can make money when they are paying between $400-$700 per door. Some can even make money at $1,000 per door. Yes, it’s hard to figure out. So start simple. Spit ball how much profit you make per year on average for a typical client. How many years does an average client stay with you? Multiply the two. That’s not the most precise way to measure LCV, but it’s a start until you can get fancier. Some approximate “best guess” numbers are generally better than no numbers, in my experience.

- Figure out what it costs you per door by lead source. Know how much a door costs from a source. Do this for all your lead sources. Why? Because then you can evaluate each lead channel independently. In reality, some lead sources are going to do better for you numbers wise. And if you can get all the leads you want from that one source, fine, you’re set. Most of the time, you can’t get all the leads you want from one source, so knowing what the CPD is by lead source helps you to know which lead channel is within your guidelines for CPD (which is very dependent on knowing Lifetime Customer Value; see point #3).

Final Thought

Why you should consider paying MORE per door?

I’m going to make one final suggestion. Once you know your numbers, and what constitutes a profitable CPD level, consider paying more per door.

Why would you consider paying more per door?

Because you want to make more money. The reality is this – some lead sources are going to be more expensive on a CPD basis. So should you only take the “bests margin” or “cheapest” CPD lead sources? Probably not.

You likely want to look at all lead sources where your Lifetime Customer Value (LCV) minus your Cost Per Door (CPD) = an acceptable profit for your company. You will make more on some lead sources and less on others, but does that matter in the end? Last time I checked, you can’t deposit LCV or CPD into the bank. They only take cash. So any lead source that is profitable should be considered.

Current editions of the award-winning Residential Resources magazine is sent eleven times a year to members. Join NARPM to receive all of the benefits of membership and receive current editions.

Residential Resources: December 2017 Issue | Volume 28 | Number 11

Copyright © 2024 National Association of Residential Property Managers®. All Rights Reserved. Do not reprint without permission.